Platform migrations, RDC conversions, ACH/wire platform upgrades, and other system changes are some of the biggest projects a bank or credit union can undertake.

For those unfamiliar with the term, a "conversion" is when a financial institution switches (or does a major update) to the software platform that runs all its major banking functions. Banks may also run RDC conversions, ACH wire platform upgrades and other system changes. Reasons to move to a new solution or update an existing one include:

- Legacy systems have stunted business growth

- Platform software doesn’t support the business process flow

- Disparate data sources have weakened reporting and analytics

- Diminished competitive advantage

- Governance, risk, and/or compliance issues

- Inability to accurately define/segment customer population

- Statements of poor customer experience

When seeking a conversion or upgrade, every bank must find the platform that best fits its strategy and individual needs. Banks must evaluate each solution based on its broad characteristics:

- Can you configure it to meet your needs?

- Does it have the basic business functions to support a customer-centric banking environment?

Customer Experience is Critical

Customers have come to expect a seamless digital experience when handling their funds. Financial companies must provide a first-class customer experience that includes:

- 360-degree customer journeys

- Fast implementations and smooth transitions

- Personalized user interfaces

- Impeccable customer service

- Optimal balance between relationship building and automation

As competition becomes more intense, banks must look for ways to deepen relationships and position themselves as their customer’s primary bank providing impeccable service at every point of their customer’s journey.

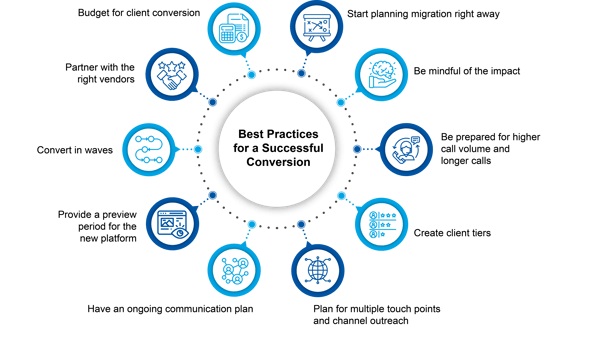

10 Best Practices for Conversion Success

With a software conversion or system upgrade, banks often focus all resources and investment on choosing the right software and making sure the technology works, which is entirely understandable. However, what can get neglected is the client experience when rolling the new software out to existing customers.

That is why we have put together 10 Best Practices for a Successful Client Conversion Experience to highlight the need to prioritize the customer experience in parallel to the implementation or upgrade of a new system.

1. Start Planning the Conversion Straight Away

There is no one-size-fits-all plan for migrating data. Every data set is different, and every organization has different requirements. Therefore, it is essential to invest the necessary time into evaluating your data migration goals and needs. From there, you can build out a unique and complete data migration plan that will help you to achieve the desired results. It is never too early to start planning and it is essential that you establish customer experience objectives at kickoff. Client conversion migration planning should be embedded in every phase of the rollout. A budget for customer conversion should be included in the business case approval plan.

2. Be Mindful of the Full Impact

Be mindful that like most IT projects, scope creep is likely. Identify major changes between legacy and target platforms and plan for them step by step bearing in mind that every change has an impact - even a one-digit change to code can break links. Be aware of file formats and new features such as tiered limits and identify and factor for exception processes. Build in plenty of scope for thorough testing so that you will be ready to launch a stable and reliable platform for a seamless customer experience.

3. Proactive Outreach to Minimize Inbound Calls

Simply put, proactive customer service means to help your customers before they reach out to you. Proactive outreach starts with understanding your customers' needs and anticipating their challenges and desires before they vocalize them. Rule of thumb is to prepare for a 5X increase in inbound call volume and a doubling of average call handle times across the first two to three weeks of a banking software migration. Plan for the correct volume of staffing to cover the expected call volume spike or consider outsourcing this section of implementation to a specialist contact center. Proactive outreach can reduce inbound calls. Each inbound call is a degradation of the customer experience and careful planning must be made to minimize inbound calls.

4. Create Client Tiers

Segment your customers by tier and allocate more resources to accounts that have the potential to drive the most revenue and/or strategic value for your business:

- Top Tier - highest value clients: white glove treatment is often reserved for the top 10% (up to 25%) of clients

- Middle Tiers: Plan appropriate customer journeys for middle-value clients

- Lower Tiers: Consider automated/self-service for lower-tier clients

Consider implementing a transition website and using analytics to map customer journeys and identify pain points.

5. Plan for Multiple Touch Points and Channel Outreach

Create customer journeys with between five to ten points of contact per client. Touch points should be determined by tier and client value. A proactive, multi-channel outreach program enhances customer experience. Accuracy of client contact information is critical from the outset. Measure and analyze customer journeys through correlating number of outbound calls against login activity. A decline in inbound calls directly corresponds with an improvement in client satisfaction. Customer participation and involvement plays a key role during the initial phase of a migration. Clearly explaining what is required and how their participation is needed is critical to a stress free experience on both a technical and customer success perspective. Some key items customers may need to be reacquainted with prior to conversion: knowing all their account access information including usernames, passwords, and web links, along with understanding if computer and bank admin rights are required to complete conversion.

6. Optimize Client Journeys and Ongoing Communication

Customer outreach needs to take place before, during and after a conversion. Plan to inform clients at least 60-90 days prior to a migration and be sure to provide a link to the transition site in all communication. Include personalized touchpoints and relevant information for your higher and middle tiers. Use outbound as an opportunity to deepen and improve client relationships, including surveys and support throughout the conversion journey.

7. Provide a Preview Period for the New Platform

Giving preview access to the new platform, typically two to three weeks prior to conversion, enables customers to log in to the new platform, get trained, update entitlements and payments (ACH, wire etc) and get a feel for the system navigation. Live webinars and pre-recorded sessions should also be available on-demand for lower tiers.

8. Convert in Waves

There are three basic routes to a new banking platform:

- Big Bang - involves full replacement all in one go

- Build and Migrate - institutions establish a new offering running on the new digital system and gradually migrate customers across

- Progressive Migration - business is sequentially migrated to a new platform

Each method has its advantages and disadvantages. Converting in waves is less risky than a big bang and arguably less stressful. By converting one wave at a time, it is easier to deal with system glitches and you can start small and ramp up to reach regular cadence by the third wave. Depending on bank size you can aim to plan for 5 to 6 waves with an average length of 5+ weeks. The first pilot is the longest and you can plan for this to last up to about 45 days. Leave your critical clients to convert in later waves once you have ironed out any glitches. Ensure there is no overlap with each phase.

9. Partner With the Right Vendors

Selecting the right vendor is essential for a successful client migration experience. Choose vendors based on track record, experience, scalability capacity, and expertise. Ensure they have forward-looking roadmaps, and their contact centers are properly staffed. Leverage vendor communication platforms for integrated, multi-channel touch points.

10. Invest in Client Conversion

Investing in client experience is essential for customer retention. A happy client has an improved relationship lifecycle with an increased propensity to use new products and services, and a greater average customer revenue. Investing in client conversion ultimately drives the ROI of the conversion project.

Client experience is critical throughout asoftware conversion or system upgrade and client service should be an equal priority alongside the technology result from the outset.

- New platforms won’t be realized without successful client conversions.

- Poor execution and a failure to focus on customer impact and experience will lead to disruption and potential attrition.

- While conversions can be both costly and challenging, they are a high impact opportunity and a required step toward better meeting client needs.

- A good customer experience is a never-ending journey and providing an exemplary one establishes a competitive advantage.

In short, while conversions are both costly and challenging, they are a high impact customer opportunity and a necessary step to better meeting client needs as well as deepening relationships.

With careful planning, the right strategy and a trusted vendor who understands the value of customer satisfaction delivering a positive client experience is very achievable during migrations and system changes.

As specialists in delivering excellent customer service, we understand the importance of a positive customer experience during software conversions, RDC conversions, ACH wire platform upgrades and other system platform changes. With a long history of excellence in treasury management, banking practices and customer experience, Superior is here to help you achieve your goals.